The Greatest Guide To Pvm Accounting

The Greatest Guide To Pvm Accounting

Blog Article

The Basic Principles Of Pvm Accounting

Table of ContentsThe Facts About Pvm Accounting UncoveredThe Ultimate Guide To Pvm AccountingThe Best Strategy To Use For Pvm AccountingThe Best Guide To Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Pvm Accounting Fundamentals ExplainedAll about Pvm AccountingPvm Accounting - Truths

One of the key factors for applying audit in building and construction tasks is the demand for monetary control and administration. Building projects frequently require substantial financial investments in labor, products, devices, and other resources. Correct audit allows stakeholders to keep an eye on and manage these financial sources successfully. Accountancy systems offer real-time insights right into job costs, earnings, and earnings, enabling project managers to without delay determine potential concerns and take corrective actions.

Construction projects are subject to different monetary mandates and coverage demands. Correct audit ensures that all monetary deals are taped properly and that the job conforms with accountancy criteria and legal arrangements.

The Only Guide for Pvm Accounting

This reduces waste and boosts job efficiency. To much better understand the relevance of bookkeeping in construction, it's additionally important to identify between building and construction administration accounting and task management accounting.

It focuses on the monetary facets of individual building tasks, such as expense estimate, price control, budgeting, and money circulation management for a specific task. Both kinds of bookkeeping are crucial, and they match each various other. Building and construction management accountancy makes sure the firm's economic health, while job monitoring accounting makes sure the financial success of specific tasks.

What Does Pvm Accounting Mean?

An essential thinker is called for, who will deal with others to make choices within their locations of obligation and to improve upon the locations' work processes. The placement will certainly communicate with state, university controller personnel, campus department personnel, and academic scientists. He or she is expected to be self-directed once the first learning contour relapses.

An Unbiased View of Pvm Accounting

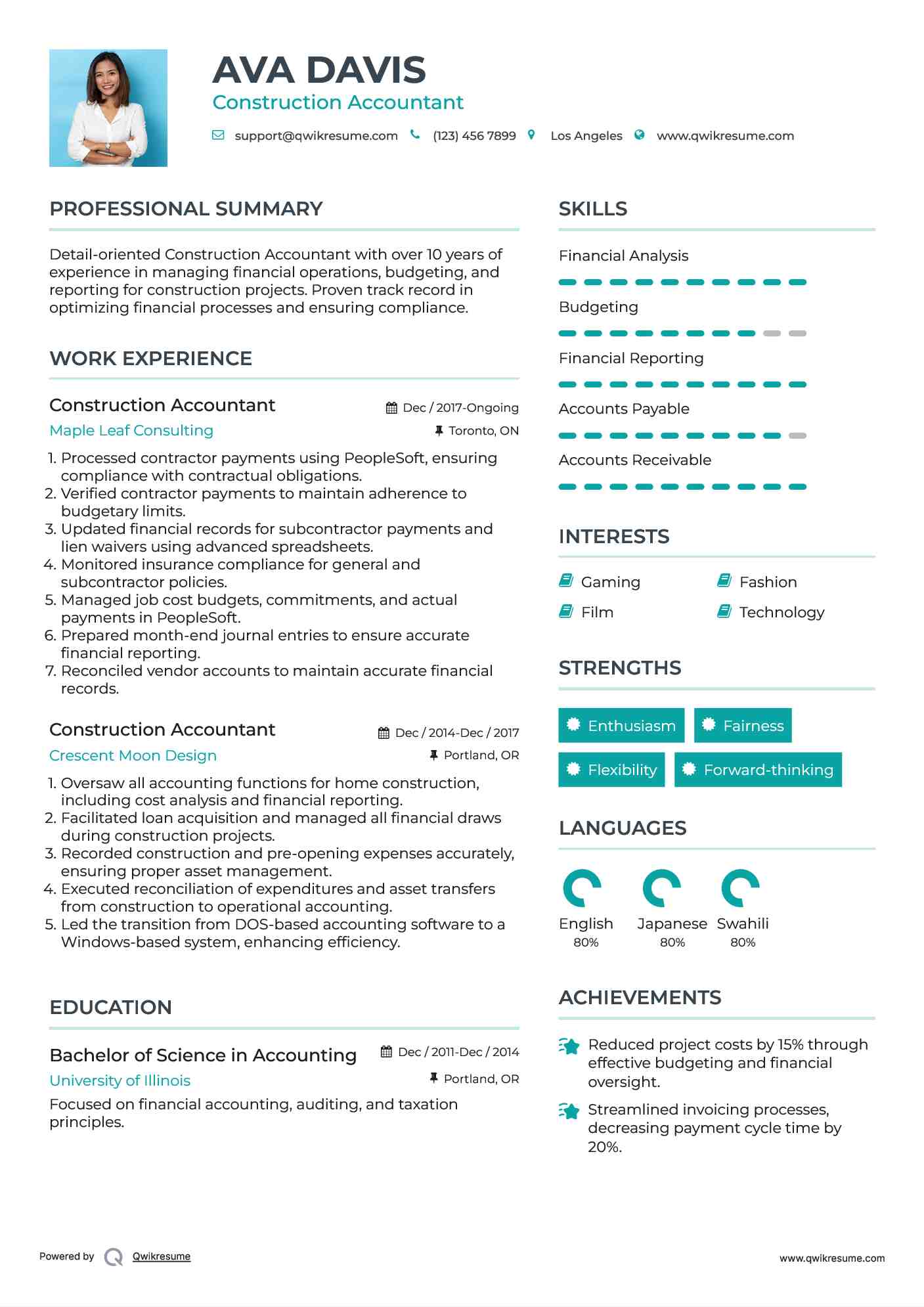

A Construction Accountant is accountable for managing the economic aspects of building and construction projects, including budgeting, price tracking, financial coverage, and conformity with regulatory demands. They function closely with project managers, contractors, and stakeholders to guarantee exact economic records, cost controls, and timely settlements. Their knowledge in building and construction bookkeeping principles, task setting you back, and financial analysis is necessary for reliable financial reports financial monitoring within the building and construction sector.

Some Ideas on Pvm Accounting You Need To Know

Payroll tax obligations are tax obligations on a worker's gross salary. The revenues from pay-roll tax obligations are made use of to money public programs; as such, the funds gathered go straight to those programs instead of the Internal Earnings Service (IRS).

Keep in mind that there is an added 0.9% tax obligation for high-income earnersmarried taxpayers who transform $250,000 or single taxpayers making over $200,000. There is no employer match for this added tax obligation. Federal Joblessness Tax Act (FUTA). Profits from this tax approach federal and state joblessness funds to help employees that have actually shed their tasks.

Facts About Pvm Accounting Revealed

Your down payments have to be made either on a regular monthly or semi-weekly schedulean political election you make prior to each fiscal year. Monthly payments. A regular monthly repayment needs to be made by the 15th of the complying with month. Semi-weekly settlements. Every various other week down payment days rely on your pay schedule. If your payday falls on a Wednesday, Thursday or Friday, your deposit is due Wednesday of the following week.

Take treatment of your obligationsand your employeesby making total payroll tax settlements on time. Collection and repayment aren't your only tax responsibilities.

What Does Pvm Accounting Do?

States have their very own payroll taxes. Every state has its very own unemployment tax obligation (called SUTA or UI). This tax obligation rate can differ not only by state but within each state. This is due to the fact that your business's industry, years in organization and joblessness history can all determine the percent utilized to calculate the quantity due.

Pvm Accounting for Dummies

The collection, remittance and reporting of state and local-level tax obligations depend on the federal governments that impose the taxes. Each entity has its own policies and approaches. Clearly, the subject of payroll tax obligations entails lots of moving components and covers a large range of accounting understanding. A U.S.-based worldwide certified public accountant can attract on competence in all of these locations when advising you on your unique service arrangement.

This web site utilizes cookies to enhance your experience while you navigate with the site. Out of these cookies, the cookies that are categorized as required are kept on your web browser as they are vital for the working of fundamental performances of the web site. We likewise use third-party cookies that help us analyze and understand just how you utilize this web site.

Report this page